- India

- International

Avenue supermart shares soar on debut: Radhakishan Damani, India’s low-profile investor

Damani, whom many consider as India’s Warren Buffett and mentor to many other heavyweight investors including Rakesh Jhunjhunwala, has been in the billionaire list for a while.

Radhakishan Damani

Radhakishan Damani

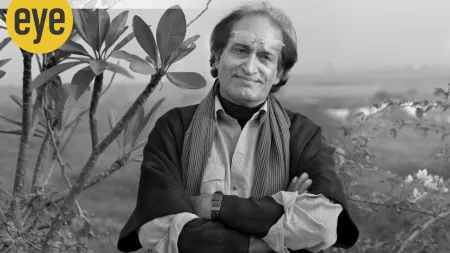

Dalal Street has witnessed the emergence of a super star — the low-profile and reclusive investor Radhakishan Damani. The blockbuster listing of Avenue Supermarts, the operator of retail chain D-Mart, on Tuesday has added considerably to the networth of Damani and his family.

Damani, whom many consider as India’s Warren Buffett and mentor to many other heavyweight investors including Rakesh Jhunjhunwala, has been in the billionaire list for a while. Avenue Supermarts which priced its initial public offering (IPO) at Rs 299 per share recently listed its stocks at a premium of over 100 per cent on the stock exchanges. As the stock surged and closed at a price of Rs 640.75, the market valuation of the company soared to Rs 39,988 crore.

As Damani and family hold 82.36 per cent stake in the company, the value of their holdings is a whopping Rs 32,934 crore now. Radhakishan Damani who is known to steer clear of the media has been one of India’s highly successful investors. His portfolio, before the listing of Avenue Supermarts, was estimated at over Rs 3,000 crore marked by smart stock picking and staying invested in several stocks “He can be called India’s Warren Buffet,” said a market source who was tracking Damani for the last two decades. Radhakishan Damani was not available for comment.

According to Forbes magazine, Damani, 61, had a net worth of $2.3 billion before listing of Avenue. Some of the successful investments of Damani include Gillette, Crisil and VST Industries. He has also invested in Somany Ceramics, Jay Shree Tea and GE Capital Transportation Industries among others.

It’s not Damani alone whose networth has zoomed based on the listing day pricing. Avenue Supermart managing director Ignatius Navil Noronha, who joined the company 12 years ago, and around 2,000 employees also became richer after the listing. Norohna, who was an accounts manager with Hindustan Unilever before he was picked up by Damani, is worth Rs 559 crore after the listing of the company. The company’s board of directors includes former Sebi chairman CB Bhave. “It will be a bonanza for employees of D-Mart who applied for the shares in the IPO,” said BSE dealer Pawan Dharnidharka.

The initial public offer of Avenue Supermarts also made waves. The offer witnessed robust investor demand and was subscribed by over 106 times with strong demand from institutional and retail investors.The IPO, the biggest since PNB Housing Finance’s Rs 3,000 crore offer in October last year, received bids for 460.22 crore shares against the total issue size of 4.43 crore shares. Anchor investors who put Rs 561 crore have also seen their returns skyrocketing in a few weeks.

“It was the most successful IPO after the listing of Birla Pacific Med Spa in July 2011. The stock market was also in a bullish phase, adding to the success of this IPO,” investment bankers said. While the price band for the IPO was set at Rs 295-299, it raised Rs 1,870 crore and the proceeds would be utilised for various purposes, including loan repayment.

On Tuesday, after listing, the scrip opened at Rs 604.40 and touched high of Rs 650 and a low of Rs 558.75 before closing at Rs 640.75, a premium of 114.30 per cent on the offer price. For the nine months to December 2016, the firm reported a total revenue of Rs 8,803 crore and a net profit was Rs 387.47 crore.

IPO witnesses robust demand

* Damani, whom many consider as India’s Warren Buffett and mentor to many other heavyweight investors including Rakesh Jhunjhunwala, has been in the billionaire list for a while

* Some of the successful investments of Damani include Gillette, Crisil and VST Industries. He has also invested in Somany Ceramics, Jay Shree Tea and GE Capital Transportation Industries among others

* The IPO of Avenue Supermarts also made waves. The offer witnessed robust investor demand and was subscribed by over 106 times with strong demand from institutional and retail investors

Sponsored | Empowering Leadership through AI Integration: Catalysing Business Transformation

May 05: Latest News

- 01

- 02

- 03

- 04

- 05